Content

For more information or virtual bookkeeping service, contact us today. And we’ll even help you understand the story behind the numbers, so you’re never left speechless in front of your finance committee. We segregate duties and provide control activities to provide an internal line of defense for your nonprofit. If we are a match and depending on the service offering you need, we’ll do a discovery session to get better acquainted. We may also conduct a data file review after the session if necessary. For over 30 years the Certified Public Accountants and Advisors at Marshall Jones have been serving the accounting, bookkeeping, and tax preparation needs of the Atlanta area.

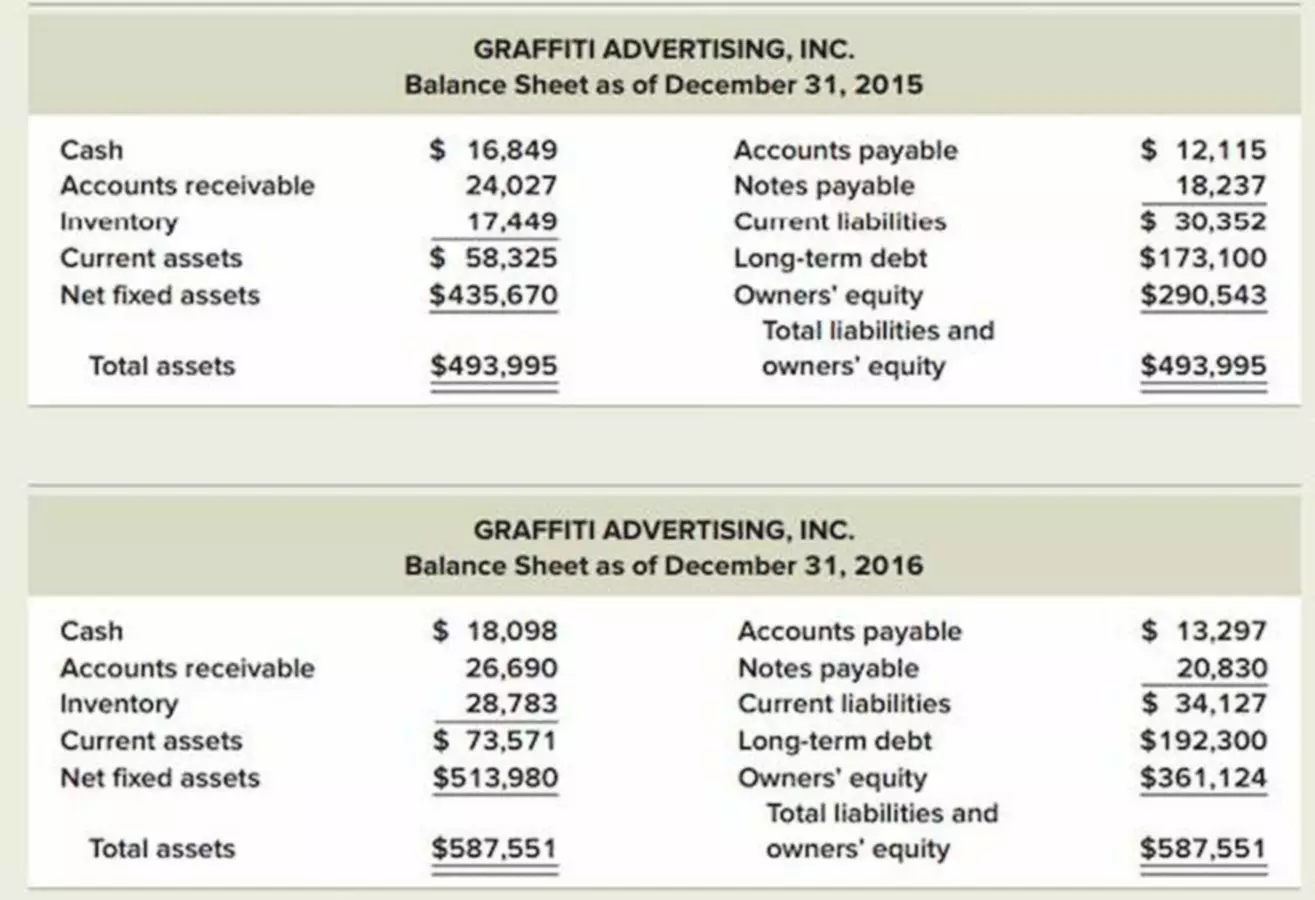

Bookkeepers are in charge of maintaining your books closely day in and day out. They are responsible for all data entry into accounting ledgers or software. Their focus is on recording the financial transactions of your organization through maintaining records, tracking transactions, and creating financial reports. Especially in the earlier stages, many nonprofits bookkeeping for nonprofits are primarily concerned with compliance. However, at some point, your organization will cross a threshold and you’ll begin to place more emphasis on the need for timely, accurate financial reports and intelligence. The primary function of ourbookkeeping services is to provide a monthly, quarterly, and annual reporting package in full accrual accounting.

Cloud-ready offshore accountants

It is a pleasure to work with Nonprofit Bookkeeping and our Board of Directors and team highly recommends their services. We will reconcile your bank accounts to prepare your balance sheet, income statement and other financial reports upon request, as well as advise you on how to read your reports. A. Our monthly bookkeeping package includes income and expenses for the month entered into QuickBooks, monthly bank reconciliations, monthly balance sheet, and monthly income statement (P&L). These statements give you quality insights into how your organization performs, thereby helping board members take the necessary steps to understand where funds are being allocated to further the mission of the nonprofit. If you are looking for an experienced nonprofit bookkeeping service near you, then look no further and partner with our company of experts. Get our FREE guide to nonprofit financial reports, featuring illustrations, annotations, and insights to help you better understand your organization’s finances.

Docs overwhelmed by mountain of new medical literature – FierceHealthcare

Docs overwhelmed by mountain of new medical literature.

Posted: Tue, 25 Oct 2022 10:00:00 GMT [source]

Your message has been received and we’ll be reviewing your request shortly. In the meantime, schedule a meeting with us and we’ll be in touch soon. We’ll create a custom price quote that’s tailored for you— to ensure you get the support you need without paying for anything that you don’t. If so, register for our free Nonprofit Financial Reports Masterclass to gain the confidence you need to discuss your finances in 3 value-packed video lessons. This means you’ll always get continuous service, no matter how complex or minor your accounting needs are.

Free Insights from our Nonprofit Accounting Firm

After you acknowledge this, we will forward you another email providing you access to our client-only web tools & questionnaire. Once you complete this online questionnaire, we will call you within 48 hrs to set up a conference call with your service consultant. During this call, the consultant will confirm information, ask you questions, answer any of your questions, and begin to work on your project. Moreover, we also offer you the choice between our three service packages. Our goal is to help your nonprofit gain control over your finances for organizational growth and success. At Good Steward Financial, we work in the best interest of your organization. Our experienced and friendly team of accountants will answer all queries and help you make timely decisions for maximum organization benefits.

To access other member benefits and resources, log into NAO’s website using your NAO User Account information. The entire team is very responsive, ready to roll up sleeves or spend time as thought partners as we grow and scale. Save the day, the month, the quarter—with 5-Minute Financials from Nonprofit Bookkeeping. Our experts will make sure all information is present and accounted for. A. We have created a document checklist that you will want to keep to inform you of what we will need each month. Keep in mind, not all items on the list may apply to your organization.

Nonprofit Bookkeeping Software

At Velan, we have been offering bookkeeping & accounting services to charitable foundations, religious and other nonprofit organizations for several years. Our goal is to assist nonprofits in improving their effectiveness and efficiency with financial management, internal controls, and periodic financial statements. Our affordable nonprofit bookkeeping & accounting services are cater to every nonprofit irrespective of the physical location, size, segment or gross receipts. If you’re searching https://www.bookstime.com/ for a nonprofit bookkeeping & accounting service provider near me then you have landed in the right place. At PABS, we have been offering accounting services to charitable foundations, mission-driven organizations, housing cooperatives, religious and other not-for-profit organizations. While you strive to focus on running lean on expenses to maximize your impact, we help you with reliable financial management, internal controls, weekly, monthly financials and cash flow statements.

Are you ready to find out why more charities, funds and non-profits choose us for their bookkeeping services? Contact usto schedule your appointment to review your possible customized service package. By continually monitoring changes in the industry, market trends, regulations, and accounting standards, our experts provide you with value-added services which go far beyond the standard accounting and compliance services. We are able to assess your priorities and develop programs, processes and procedures to help you run your organization successfully. When you select board members or hire an individual to serve as your executive director, you likely aren’t selecting them for their strong background in bookkeeping and accounting. Likely, you choose them based on their list of contacts, fundraising abilities, and proven commitment to your cause.

Software Agnostic

We will ensure compliance with laws and regulations and discover operating inefficiencies. Our extensive experience with nonprofits enables us to understand the challenges faced by our clients from the board of directors, management and funding sources perspectives. An integral part of our role is helping our clients communicate effectively with all of their stakeholders. We also offerpayroll services for nonprofits and specializedbookkeeping services for churches & charitable organizations, schools, soup kitchens, rehabilitation centers and other types of service organizations. As a 501c3 nonprofit organization, you need to focus more on your missions than managing the books. A part-time bookkeeper or a volunteer accountant may not always be able to present the financial insights to make well-informed decisions.